- The Strategic Tax Advisor

- Posts

- Understanding Progressive Tax Brackets for High Earners

Understanding Progressive Tax Brackets for High Earners

Why Your Marginal Rate Isn't Your Actual Tax Bill (And What That Means for Six-Figure Earners)

If you've recently crossed into the $400,000+ income territory, congratulations on your success. But you might have noticed something peculiar about your tax situation: despite hearing you're in the "37% tax bracket," your actual tax burden doesn't feel like you're handing over 37% of everything you earn. There's a good reason for that, and understanding this distinction could fundamentally change how you approach tax planning and financial decisions.

Let's demystify one of the most misunderstood aspects of the American tax system: progressive tax brackets. Once you truly grasp how these work, you'll see why some common fears about earning more money are actually based on misconceptions, and you'll be better equipped to make strategic financial moves throughout the year.

The Foundation: What "Progressive" Really Means

The United States uses a progressive tax system, which sounds complex but is actually built on a straightforward principle: your income isn't taxed at one flat rate. Instead, imagine your income as water filling up a fountain with multiple tiers. Each tier represents a bracket, and only the water that reaches each tier gets taxed at that tier's rate. The water at the bottom always stays taxed at the lower rate, no matter how full the fountain gets.

This is fundamentally different from what many people instinctively imagine. When someone hears they're "in the 37% bracket," they often picture their entire income being taxed at 37%. But that's not how it works at all. Let's see exactly what happens to your money as it climbs through the tax system.

The 2025 Federal Tax Brackets: Your Roadmap

For the 2025 tax year, here's how the federal income tax brackets are structured for single filers. Understanding these numbers is essential because they form the foundation of every calculation we'll explore:

2025 Federal Income Tax Brackets for Single Filers. Each bracket applies only to the portion of your income that falls within that range, not your entire income. This progressive structure is why your effective tax rate will always be lower than your marginal rate.

Key Insight: Notice that the rates apply to ranges of income, not your total income. This is the critical concept that changes everything.

Marginal vs. Effective Tax Rate: The Distinction That Matters

Here's where we need to slow down and really understand two terms that sound similar but mean very different things. Your marginal tax rate is the rate you pay on your last dollar earned. It's the bracket you've climbed into. Your effective tax rate, however, is the average rate you pay across all your income. It's your total tax bill divided by your total income.

Think of it like climbing a mountain where different sections have different slopes. Your marginal rate tells you how steep the section you're currently on is. Your effective rate tells you the average steepness of your entire climb from bottom to top. As you can imagine, the average is always gentler than the steepest section because you had to cross all the easier sections to get there.

Marginal Tax Rate

The rate applied to your next dollar of income. This determines how much extra tax you'll pay if you earn more. This is useful for deciding whether to take on extra work, when to realize capital gains, or timing income.

Effective Tax Rate

The rate applied to your total income on average. This is your actual tax burden as a percentage. This is useful for understanding your real tax situation, budgeting, and comparing your burden year-over-year.

A Real-World Example: Meet Sarah

Case Study: Sarah's $450,000 Income

Sarah is a successful tech executive who earned exactly $450,000 in 2025. She's single with no dependents. Let's walk through her tax calculation step by step to see how the progressive system actually works on a high income.

Many people hear that Sarah is "in the 35% tax bracket" and assume she pays $157,500 in taxes (35% of $450,000). But watch what actually happens when we calculate her taxes correctly:

Sarah's Income Flowing Through the Tax Brackets

First $11,925 taxed at 10%: $11,925 × 10% = $1,192.50

Next $36,549 ($11,926 to $48,475) taxed at 12%: $36,549 × 12% = $4,385.88

Next $54,875 ($48,476 to $103,350) taxed at 22%: $54,875 × 22% = $12,072.50

Next $93,950 ($103,351 to $197,300) taxed at 24%: $93,950 × 24% = $22,548.00

Next $53,225 ($197,301 to $250,525) taxed at 32%: $53,225 × 32% = $17,032.00

Last $199,475 ($250,526 to $450,000) taxed at 35%: $199,475 × 35% = $69,816.25

Total Federal Income Tax: $127,047.13

Now let's compare Sarah's rates:

Sarah's Marginal Tax Rate: 35% (the rate on her last dollar earned)

Sarah's Effective Tax Rate: $127,047.13 ÷ $450,000 = 28.23%

The Difference: Nearly 7 percentage points! That's over $30,000 in difference if you mistakenly thought she paid 35% on everything.

Visualizing the Progressive Nature

Let's make this even clearer by understanding how Sarah's $450,000 gets divided across the brackets:

The first $11,925 (2.65% of her income) is taxed at 10%

The next $36,549 (8.12% of her income) is taxed at 12%

The next $54,875 (12.19% of her income) is taxed at 22%

The next $93,950 (20.88% of her income) is taxed at 24%

The next $53,225 (11.83% of her income) is taxed at 32%

The last $199,475 (44.33% of her income) is taxed at 35%

The largest portion of Sarah's income falls in the 35% bracket, but all the lower brackets contribute to a much lower overall effective rate.

What This Means at Different High-Income Levels

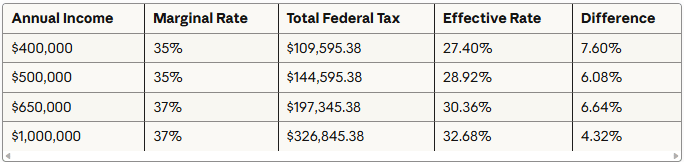

Let's examine how this progressive structure affects people at different six-figure income levels. The pattern is consistent: as you earn more, your effective rate increases, but it never catches up to your marginal rate because you always benefit from those lower brackets at the bottom:

Marginal vs. Effective Tax Rates at Different Income Levels. Notice how the gap between marginal and effective rates remains significant even at seven-figure incomes, demonstrating that high earners still benefit from lower tax rates on their initial earnings through the progressive bracket system.

Notice something interesting: as income rises, the effective rate does increase and gets closer to the marginal rate, but there's always a gap. Even at $1 million in income, you're paying an effective rate of about 33%, not 37%. That's because you still get the benefit of all those lower brackets on the first portions of your income.

Common Misconceptions That Cost High Earners

Misconception #1: "If I earn more and jump to a higher bracket, I'll take home less money"

This is perhaps the most damaging myth in tax understanding. Because only the income that falls into the higher bracket gets taxed at the higher rate, you will always take home more money by earning more. Let's prove this with an example.

Suppose you're earning $250,000, and you get offered a $10,000 bonus that pushes you into the next bracket. That $10,000 gets taxed at 35% (the next bracket up), meaning you pay $3,500 in tax on it. But you still take home $6,500 more than if you hadn't earned it. You're better off, not worse off.

Misconception #2: "High earners pay taxes on everything at the top rate"

As we've seen extensively with Sarah's example, this simply isn't true. Even someone earning $10 million pays 10% on their first $11,925, 12% on the next chunk, and so on. The progressive nature of the system never disappears, regardless of how high your income climbs.

Misconception #3: "My effective tax rate is close to my marginal rate"

Many high earners are surprised to learn their effective rate is several percentage points lower than their marginal rate. This gap represents real money—potentially tens of thousands of dollars—that you're keeping rather than paying in taxes. Understanding this can change your perspective on compensation negotiations, bonus timing, and investment strategies.

Strategic Implications for Your Financial Planning

Understanding the difference between marginal and effective rates isn't just an academic exercise. It has real implications for how you should think about various financial decisions throughout the year.

When Marginal Rate Matters Most

Your marginal rate is what you should focus on when making decisions about incremental income or deductions. If you're deciding whether to make a tax-deductible contribution to your traditional 401(k), for instance, you'll save taxes at your marginal rate. If you're in the 35% bracket, every dollar you contribute saves you 35 cents in federal taxes.

Similarly, if you're considering when to exercise stock options or realize capital gains, your marginal rate tells you how much additional tax you'll incur. This becomes particularly important if you're near a bracket threshold. Timing a $100,000 stock option exercise when you're at $240,000 of income versus $260,000 of income could mean the difference between paying mostly 32% versus mostly 35% on those gains.

When Effective Rate Tells the Real Story

Your effective rate is crucial for understanding your overall tax burden and planning your lifestyle and savings. If your effective rate is 28%, you know that roughly 28 cents of every dollar you earn goes to federal income taxes on average. This is the number you should use when budgeting, projecting your net income, or comparing your tax situation year-over-year.

It's also valuable when evaluating job offers or career moves. If you're offered a position with a $500,000 salary versus your current $400,000, you might instinctively think you'd be losing 35% of that $100,000 raise to taxes. But in reality, your effective rate would only increase from about 27.4% to 28.9%—your overall burden increases, but not as dramatically as the marginal rate might suggest.

Beyond Federal Income Tax: The Complete Picture

It's important to remember that we've been focusing exclusively on federal income tax throughout this discussion. Your complete tax picture includes several other components that high earners need to consider. State income taxes can add anywhere from zero (if you live in a state like Texas, Florida, or Washington) to over 13% (in California) to your tax burden. These state taxes often have their own progressive structures, though some states use flat rates.

Additionally, high earners face the Additional Medicare Tax of 0.9% on earned income above $200,000 (single filers) and the Net Investment Income Tax of 3.8% on investment income above certain thresholds. Social Security tax (6.2%) caps out once you hit the wage base limit, which is $176,100 for 2025, so it becomes less significant as a percentage of total income for six-figure earners.

When you layer all these taxes together—federal income tax, state income tax, payroll taxes, and any local taxes—high earners in high-tax states might face combined marginal rates approaching or exceeding 50%. However, even with all these taxes combined, the principle we've discussed today still holds: your effective rate across all these taxes will be lower than your marginal rate because of the progressive structure.

The Takeaway: Knowledge Is Financial Power

Understanding the mechanics of progressive taxation transforms how you think about earning, saving, and planning. You now know that climbing into a higher tax bracket isn't the financial disaster that some people fear. You understand that your effective rate—the real percentage of your income going to taxes—is meaningfully lower than your marginal rate, and you can see exactly why.

This knowledge empowers you to make better financial decisions throughout the year. You can evaluate the true after-tax impact of bonuses, raises, and investment gains. You can have more informed conversations with your financial advisor or tax professional about timing income and deductions. And perhaps most importantly, you can tune out the noise and misconceptions that pervade discussions about taxes and focus on strategies that actually move the needle.

For high earners, every percentage point matters because you're working with large numbers. Understanding the difference between a 37% marginal rate and a 28% effective rate on a $450,000 income means understanding a $40,000+ difference in your tax bill versus what you might have feared. That's real money that stays in your pocket—money you can invest, save, or use to improve your quality of life.

As we continue this series on tax planning for high-income earners, we'll build on this foundation to explore specific strategies for minimizing your tax burden legally and ethically. But everything starts here, with a clear understanding of how the system actually works. Master this, and you're already ahead of most taxpayers at any income level.

Disclaimer

This blog post is provided for educational and informational purposes only and does not constitute tax, financial, or legal advice. Tax laws are complex, subject to change, and can vary significantly based on individual circumstances including filing status, state of residence, income sources, deductions, credits, and other factors not covered in this general discussion.

The examples, calculations, and scenarios presented in this article are simplified illustrations designed to explain concepts and may not reflect the complete tax picture for any individual. Actual tax calculations involve numerous variables, including but not limited to: itemized versus standard deductions, alternative minimum tax (AMT) considerations, various tax credits, phase-outs, state and local tax implications, and specific provisions that may apply to your unique situation.

The 2025 tax brackets and figures used in this article are based on projected inflation adjustments and may be updated by the IRS. Always verify current tax rates and income thresholds with official IRS publications or a qualified tax professional.

This content should not be relied upon as the sole basis for any tax or financial decisions. Before implementing any tax strategies, making significant financial decisions, or taking any action based on information in this article, you should consult with a qualified tax professional, certified public accountant (CPA), enrolled agent, or tax attorney who can review your specific circumstances and provide personalized advice.

The author and publisher of this content disclaim any liability for any adverse consequences that may result from the use or interpretation of the information provided herein. Tax planning is highly individual, and what works well for one person may not be appropriate for another.